By: Lily McCormick

Canceling student loan debt has been a concern for many college graduates over the past several years. Many saw the pause of student loans payments through the COVID-19 relief bill as a sign of the cancelation to come. But, payments are set to begin again on May 1st of this year, leaving many to wonder how they will pay them.

To understand the student loan crisis it is important to understand how it is affecting Americans today. The topic of student loan debt is often seen as a blanket issue affecting everyone to a similar degree. But, recent statistics show that some students will be paying more than their fair share come May 1st.

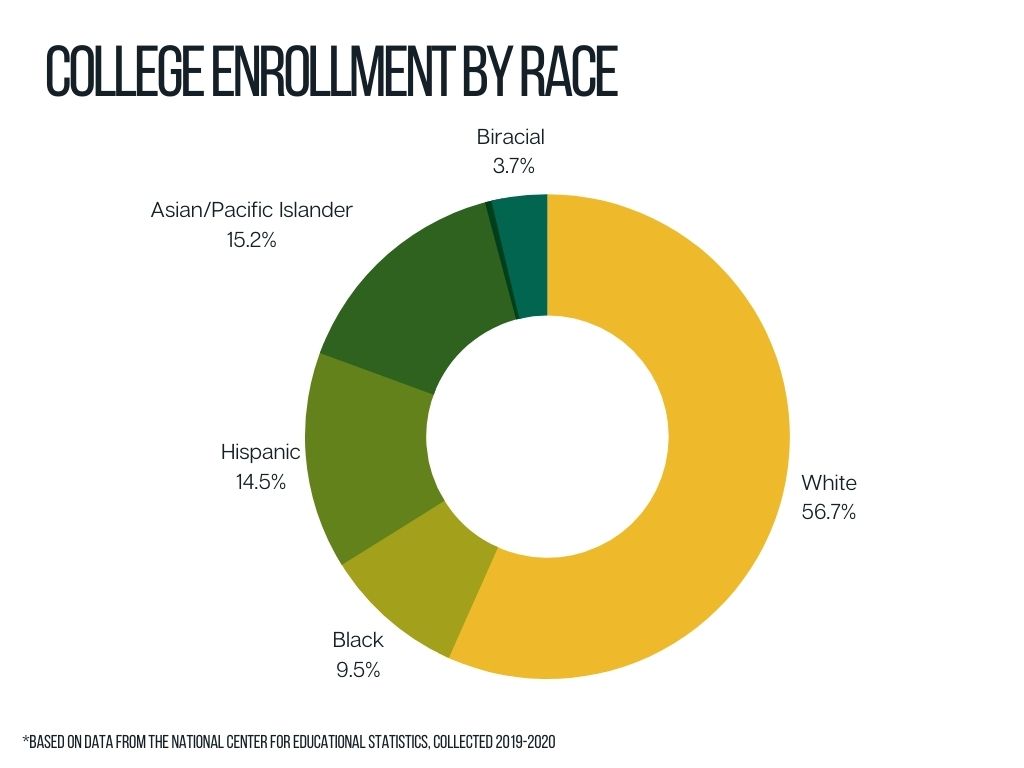

One issue of student loans is highlighted when looking at overall student enrollment by race. In the 2019-2020 data set, over half of all bachelor’s degrees conferred by postsecondary institutions were given to those who identify as white. This is proportional to the US Census that 2021 estimates the Caucasian population to make up about 76% of the total population.

But, the statistical data on student loans show a very different story. According to the National Center for Educational Statistics, racial minorities are more affected by student loans than white students. The Education Data Organization goes on to explain that 54% of student loan debt is held by Caucasian student borrowers. This is directly proportional to the number of Caucasian students graduating, but the same study shows that “African American student borrowers owe an average of $25,000 more than Caucasian students.”

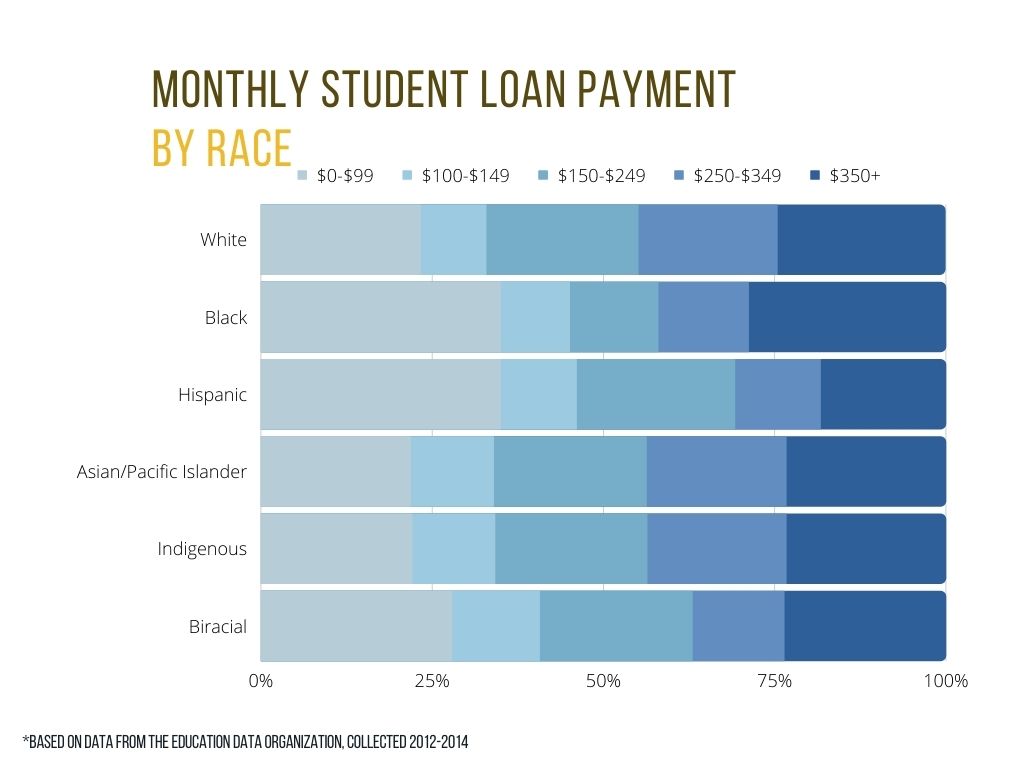

“The average time to pay back a loan is ten years, that is the national standard for student loans,” said Nikki Bradbury, the Director of Financial Aid at the University of Montevallo. This time period varies and for students taking out private loans that have higher interest rates it can take longer to pay back their loans. These interest rates can add up over time for those not able to make high enough payments each month. The difference can be shown in a few years.

The Education Data Organization notes that “four years after graduation, 48% of Black students owe an average of 12.5% more than they borrowed.” While, Caucasian students “After that same period, 83% of White students owe 12% less than they borrowed.”

The Center for Educational Statistics found that the average was $57,700 for African-American borrowers. So, even with a higher monthly payment of $350 it would take them 12 years to pay back the original loan, without calculating in interest acquired on the loan.

The average amount for Caucasians to borrow, and also the lowest average across all races, was 43,800. This means it would take them just over 10 years to pay off their loan without interest.

For students here at the Univesity of Montevallo, there is a lot more support. Many students know how easy it is to apply for loans, but how hard it can be to pay it back.

“The loan process was fairly simple for me after putting down my financial aid information,” said Avry Zow. Zow is currently a sophomore at the University of Montevallo and took out some student loans to cover his costs. However, like many students, he has some anxieties about paying them back.

“It does occasionally cross my mind that I’m going to have to pay back my loans and it makes me worry that if I don’t secure a job right out of college they’re going to come put me in jail or something,” Zow said. But, Bradbury reassures students that paying them back is possible.

“The university’s default rate is much lower than the state and national average and we do a great job here of providing need-based aid for students,” Bradbury said. Bradbury goes on to explain that there is a number of financial counseling resources for students.

“I work more with incoming students, but there is an entire financial aid department ready to help and answer questions,” Bradbury said.

For more information on student loans and paying them, please check out the University of Montevallo’s Student Aid Department or their office located in Palmer Hall.