By: Bell Jackson

In America, the student loan debt grows six times faster than the economy.

The problem is only gaining in severity, as many students at the University of Montevallo are well aware.

In 2003, the nation’s student loan debt average was $0.33 trillion. Today, that number is at $1.7 trillion.

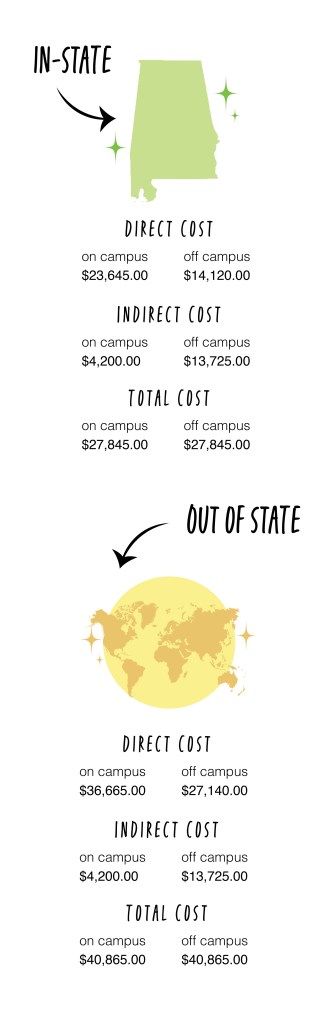

At the University of Montevallo, the average cost of attendance for an in-state student living on campus is $27,600, and out of state is $40,800.

UM offers tuition payment plans to help students and their families budget instead of paying up front.

Nikki Bradbury, Director of Student Accounts, advises students whose financial aid does not fully cover the student’s UM bill to take advantage of the payment plan.

“Utilizing the payment plan allows the student to break any remaining balance into multiple, more manageable, payments. By doing so, the student can better budget monthly. Knowing the monthly payment allows the student to factor it into the student’s monthly budget’s expenses line items,” Bradbury said.

She believes college students today would benefit from writing out a monthly budget based on the amount of tuition they owe, needs that they need to be met, and wants that they may have.

The University of Montevallo estimates that students will spend $23,600 for the direct costs of attendance such as tuition, housing, and meal plan. For the same accommodations, it costs $36,600 for out of state students.

For both in-state and out of state students, the estimated costs of books, transportation and personal expenses is $4,200.

However, some students are responsible for covering all of their expenses including UM student bill, insurance, housing, utilities, food, phone, internet, transportation and other needs.

To write your own budget, you should:

- Calculate your net income

- List your monthly expenses

- Organize your expenses into fixed (needs) and variable (wants) categories

- Calculate how much each expense costs

- Compare how your budget is different from the University’s estimations

Once you calculate how much your needs and wants cost, subtract them from your monthly income. Now you will be able to determine if you can afford your lifestyle.

If not, you may consider options for gaining more income like picking up more hours at work, but you should also consider ways you can cut costs.

You can do this by choosing to eat at home instead of restaurants, a $10 pizza a week can add $2,000 to your college costs over a four-year college career. You can also minimize travel by carpooling when you want to visit home or explore the surrounding cities.

Having a part-time job during college is a major factor in determining how much extra cash a student has in their budget for extracurriculars.

“Work, both inside and outside the classroom, will allow students to take hold of the maximum amount of earned income and scholarships, which are the two best resources to offset the need for student loans,” said Bradbury.

For a four year degree, you will need to dedicate between $111,000-$163,000 to the University of Montevallo.

The best way to manage this cost is through scholarships, jobs and budgeting. For more information on borrowing loans or financial literacy, contact the Student Aid Office.