By John Limbaugh

Gas prices have fluctuated more since the turn of the millennium than they ever did in the 20th Century. In January 2008, they rose to their highest point in U.S. history at the end of a decade-long energy crisis, then fell with the economic recession and remained inconsistent through the 2010s.

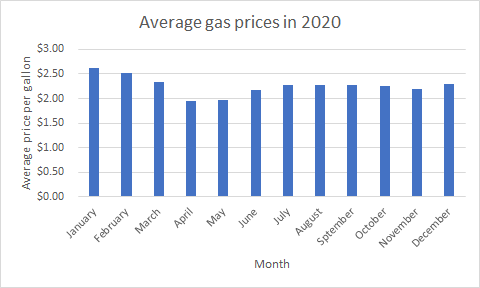

In Spring 2020, gas prices plummeted due to widespread locks downs caused by the pandemic. Now two years later the national average price of gas is $4.32 per gallon, the highest it’s been since 2008.

The price of gas rises whenever the price of the crude oil used to make it does. Crude oil prices are affected by supply and demand. John Branch, a political science expert at the University of Montevallo says that oil prices are directly affected by the state of the economy.

“Any factor that affects economic growth will cause oil prices to change,” Branch says, “Be it war, natural disaster, or any form of political crisis.”

There are three big reasons for the spike in gas prices over the last two years.

Post Pandemic demand for gas

When COVID began impacting the U.S., demand for gas fell as Americans quarantined at home. According to AAA, “Daily trips for all modes of transportation fell to an average of 2.2 trips per day.”

This sharp decline in demand caused gas prices to fall to an average of $1.24 per gallon in April 2020. When vaccines appeared, Americans began driving again,

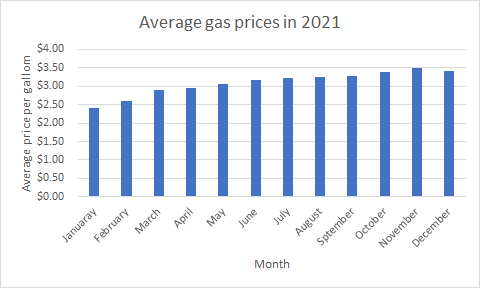

driving up the demand and price of gas. In March 2021, the nation average gas price was $2.82.

Oil production cuts

When demand for gas fell, the Organization of Petroleum Exporting Countries and other major oil suppliers cut their production of gas. Together these suppliers cut nearly a tenth of the global supply.

When the global economy began recovering from the Pandemic, OPEC Struggled to bring its production back up to match the rising demand.

According to the U.S. Energy Information Administration, it wasn’t until July 2021 that the OPEC began increasing their production of oil. At this time the demand for crude oil outpaced the global supply, raising gas prices once again.

War in Ukraine

The economic effects of the war in Ukraine are an example of just how interconnected the oil industry is. Now that the U.S. and EU have agreed to sanction Russian oil, it’s value has decreased and it can no longer be sold as easily.

The U.S. doesn’t rely on Russia for it’s crude oil or other fuel exports, however. According to the most recent U.S. government statistics, Russia sent 90,000 barrels of crude oil per day to the the United States in December, 2021. At the same time, Russia sent 8 million barrels, to global markets.

60% of those barrels went to Europe and another 20% to Asia. this shows that most of Russia’s oil goes to Europe and Asia However, oil is priced on global commodity markets, so losing Russian oil affects oil prices around the world by upending the pipeline network.

This will make countries’ paths to getting oil longer and more expensive. Even as the world’s largest oil supplier, the U.S. doesn’t produce enough oil to meet its own needs. It relies heavily on foreign countries, most notably Canada and Saudi Arabia. Last year Russia produced more oil than both of these countries.

Russian oil is a high demand global product that is now under-supplied. In simple economic terms, this means that oil prices will now rise.

Future Outlook

Last week the national average price for gas slightly fell from $4.33 to $4.27 per gallon. This is a slow response, however, to the rate that crude oil prices began to drop around the same time. So why aren’t gas prices falling with oil prices?

This is a phenomenon known as “Rockets and Feathers,” referring to the tendency for gas prices to “go up like a rocket when oil spikes,” but only “drop like a feather when crude oil crashes.”

Haresh Gurnani, a professor of supply chain management at Wake Forest University explains that gas stations are not willing to lower their prices just because crude is cheaper, because they can’t predict how oil prices will change in the coming days and weeks.

“They would rather take advantage of the consumer getting used to those elevated prices,” Gurnani says, “Now if there is some predictable reduction in prices, they can afford to pass on those savings to the consumers.”

The outlook is that gas prices are connected to the price of oil. The price of oil is connected to supply and demand. Right now Oil supply is limited at a time when demand is higher than usual.

If the price of oil continues to drop, gas prices will lower slowly over time. Gasbuddy, a tech company that measure and compares fuel prices in North America, estimates that gas prices should gradually drop to around $3.08 by December 2022.